When I launched my first startup back in 2016, I wanted to automate all the work I hated doing as a real estate analyst and project manager. Analyzing rent rolls and operating statements, pulling comp data, determining rent growth rates, etc… all of it was time consuming and extremely manual, and I couldn’t understand why the industry worked this way.

Our mission was to automate the underwriting process for multifamily properties. We aggregated data from millions of apartment listings, from open data portals, census data, crime data – everything we knew was useful for evaluating deals. And we came up with a suite of algorithms that could extract data from rent rolls and operating statements, put it alongside rent comps and expense benchmarks, and essentially let people model how their investment would perform based on their value-add or development plans.

Automating the underwriting process was a noble goal. Who wouldn’t want to do the whole thing automatically? But the reality is, real estate people all have their proprietary model that they built after decades working in the industry, and they all have their own underwriting methods that they have used to get a competitive edge. They also like tweaking assumptions and iterating to make a deal work. It requires experience and creativity, and to be honest, that's the fun part. I think to a certain extent, we tried to do too much.

Fast forward to 2023. After 7 years building technology primarily for lenders and brokers, and hundreds of conversations with originators, underwriters and servicers, we have a strong understanding of the pain points in the commercial mortgage industry.

- We know how hard it is to get brokers and producers to enter data in Salesforce.

- We know how much servicers spend each year manually extracting data from documents.

- We know recruiting is a battlefield, and companies continually worry about losing their best producers and underwriters to more tech-enabled competitors.

- And we know companies want to leverage the latest and greatest in AI, but that it’s difficult to get new initiatives off the ground when you’re constantly working on deals.

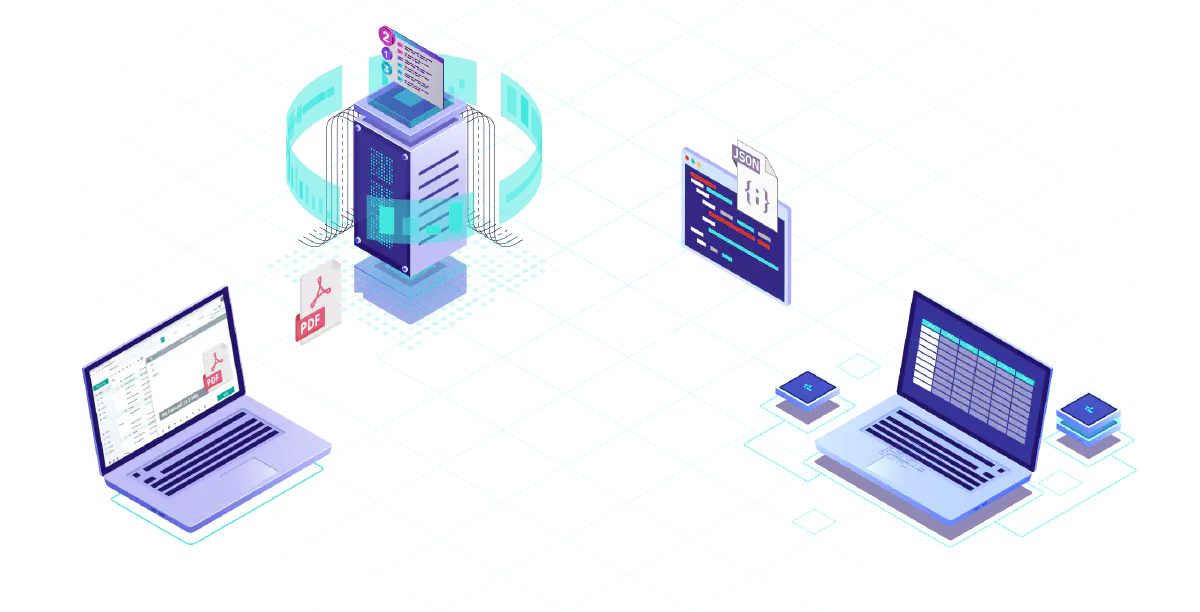

So with our AnyExtract.ai product, we’ve focused on unlocking data from the most difficult real estate documents, including appraisals, commercial leases, loan documents and offering memos. These documents vary substantially depending on who creates them, and they have both tables and unstructured text to work with. Plus, people are inundated with them… nearly every commercial real estate deal has an OM, an appraisal, loan docs, and leases to review.

Our goal is to extract data from these documents entirely via API and seamlessly inject the data into existing workflows – no new interface to learn, no painstaking training. So we collaborate with clients to integrate the outputs into Salesforce, Excel, your loan origination system – wherever real estate people do their work.

This time around we definitely don't want to automate the underwriting process, but automating the due diligence process makes a ton of sense.

Imagine if you could extract data from every lease in a property in minutes and automatically compare that data to the rent roll for a lease audit?

What if you could analyze every loan in a CMBS portfolio in a similar timeframe, and instantly identify provisions to investigate further?

The value that can be created by automating even a piece of the due diligence process is substantial.

If we can generate a commercial lease abstract in minutes vs hours, capture comparable sales data from appraisals without an underwriter ever opening the document, and help acquisitions analysts deal with the continual onslaught of offering memos flooding their inboxes each week, I think we’re going to make life a whole lot better for real estate professionals.

We have the team, and we have the technology - the future looks bright for commercial real estate!